Page 1 of 1

KK Beiträge

Posted: Wed Aug 13, 2025 6:04 pm

by kiplette

OK, this is an old chestnut, but having read everything the search showed up on here, maybe this topic hasn't been directly asked on this new forum.

A chap an hour and a half down the road who is an employee here in Germany and also a veteran (UK) started getting his mil pension in April and the GKK (AOK) want him to back pay 20% - ish of this pension and then continue to pay this.

I think that's nonsense, He pays Beiträge as an employee - the usual 7,5% or whatever, the employer paying the other bit, and also presumably Pflege.

His other worldwide income only becomes of interest to the GKK if he becomes a Freiwillige member for whatever reason (eg. retires early)

They are being very insistent about this. Assuming I am right (quite possibly I am not) then what can he present to get out of this situation?

Re: KK Beiträge

Posted: Wed Aug 13, 2025 7:59 pm

by PandaMunich

Re: KK Beiträge

Posted: Thu Aug 14, 2025 11:44 am

by kiplette

Thank you for that.

Gosh. Ours specifically said, get a job, it'll be cheaper for you because we'll only take Beiträge from the wage, which is what we then did for a year.

Re: KK Beiträge

Posted: Fri Aug 15, 2025 11:06 am

by PandaMunich

In that case, tell him to change to your Krankenkasse

Re: KK Beiträge

Posted: Sat Aug 16, 2025 9:40 pm

by kiplette

Yup, said that straight away

Re: KK Beiträge

Posted: Tue Aug 19, 2025 1:19 pm

by warsteiner70

A quick question on this - the link that Panda posted mentions:

Ich arbeite in Teilzeit oder in Vollzeit

Sie verdienen monatlich mehr als 556 EUR? Dann werden Sie als Arbeitnehmerin oder Arbeitnehmer versicherungspflichtig. Für Ihr Gehalt fallen Beiträge zur Kranken- und Pflegeversicherung an, die Ihr Arbeitgeber für Sie abführt.

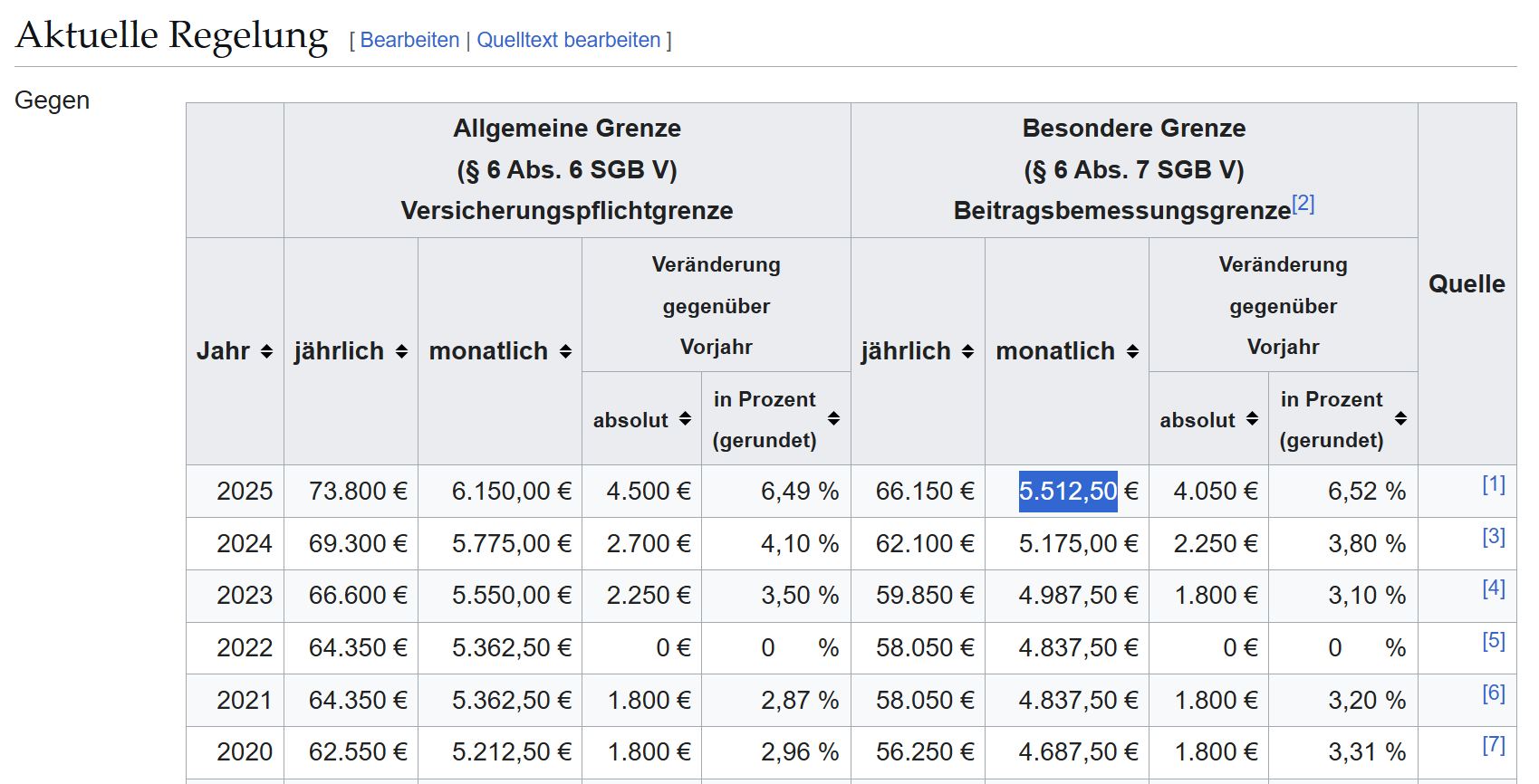

Nicht nur aus Ihrem Gehalt, auch aus Ihrer Rente fallen Beiträge zur Kranken- und Pflegeversicherung an. Möglicherweise zahlen Sie deshalb insgesamt höhere Beiträge, als gesetzlich vorgesehen ist. Der Höchstbetrag (Beitragsbemessungs-Grenze) liegt 2025 bei 5.512,50 EUR

So, if someone earns more than 5.512,50 per month from their full-time job and then gets a pension on top, does this mean that the pension isn't subject to KK tax?

I will be in a similar position in a few years with working full-time but will receive a small UK mil pension.

Re: KK Beiträge

Posted: Tue Aug 19, 2025 9:03 pm

by PandaMunich

warsteiner70 wrote: ↑Tue Aug 19, 2025 1:19 pm

So, if someone earns more than 5.512,50 per month from their full-time job and then gets a pension on top, does this mean that the pension isn't subject to KK tax?

I will be in a similar position in a few years with working full-time but will receive a small UK mil pension.

Yes.

You

never owe contributions on income that is above the Beitragsbemessungsgrenze, not even if you are a voluntary member of public health insurance.

The Beitragsbemessungsgrenze, which for public health insurance is also called "Besondere Grenze (§ 6 Abs. 7 SGB V)" changes every year:

https://de.wikipedia.org/wiki/Jahresarb ... e_Regelung

For 2025, it is 5,512.50€ per month:

- 2025-08-19 21_01_21-.jpg (184.06 KiB) Viewed 1062 times

Re: KK Beiträge

Posted: Wed Aug 20, 2025 8:31 am

by warsteiner70

Great, thanks Panda