Page 1 of 1

UK property income in German tax return

Posted: Sat Jan 18, 2025 2:15 pm

by aerosmudge

Hello everyone,

I have a question regarding putting my UK property income into my German tax return (I couldn't find a thread on this topic but if there is one I will delete this).

From my understanding of what I have found over the last few years' I have done the following (fictitious figures):

Income calculation

Rent per month = GBP 850 (below personal allowance in UK of GBP 12,750 so no tax to pay there)

Exchange rate per month * 850 = EU income

Source -

https://www.bundesfinanzministerium.de/ ... kurse.html

Total income = EU 12,000

Costs/Outgoings

Depreciation:

House bought in 25.09.2003

House price + Lawyer + estate agent = GBP 170,000

GBP/Euro exchange rate in October 2003 = 0,69693

Source -

https://www.bundesbank.de/resource/blob ... s-data.pdf

Cost in Euro - GBP 170,000 / 0,69693 = EU 243,926

House cost at 80% = EU 243,926 * 0.8 = EU 195,141

Source -

https://helfer-in-steuersachen.de/index ... nwert.html

Depreciation at 2% = EU 195,141 * 0,02 = EU 3902.83

Expenses:

Per month: (Mortgage interest + repair costs)*Euro exchange rate

Total for year = EU 6,200

So:

Income - EU 12,000

Costs - EU 6,200

Depreciation - EU3902.83

Total = 12,000 - 6,200 - 3902.83 = EU 1,900 (approximately)

This is then the figure I will put into line 36 Anlage AUS

My questions are:

1. Is what I have done still correct?

2. Can I claim for all of the mortgage interest or only some of it? In the UK now it is only 20%

3. Do i still need to do all of this if I made a loss last year (due to house renovations)?

Thanks in advance!

Smudge

Re: UK property income in German tax return

Posted: Sat Jan 18, 2025 5:44 pm

by PandaMunich

- Yes.

- All of the mortgage interest.

- Yes, since you will create a loss that will be carried forward and which will reduce your UK rental profit in a future year.

In case of a loss that year, please enter it into the column "nicht ausgleichsfähige Verluste" in the section "Nach DBA steuerfreie negative Einkünfte i. S. d. § 2a Abs. 1 EStG" of the form Anlage AUS: https://www.steuertipps.de/finanzamt-fo ... nd-steuern

Re: UK property income in German tax return

Posted: Sun Jan 19, 2025 9:32 am

by aerosmudge

That's great, many thanks Panda!

Re: UK property income in German tax return

Posted: Sun Jan 19, 2025 7:05 pm

by Alberto

Isn't the depreciation only for the first 20yr?

Re: UK property income in German tax return

Posted: Sun Jan 19, 2025 11:36 pm

by PandaMunich

Alberto wrote: ↑Sun Jan 19, 2025 7:05 pm

Isn't the depreciation only for the first 20yr?

The depreciation period is:

- 33.333 years, i.e. 3% per year if the building was built in 2023 or later.

- 50 years, i.e. 2% per year for buildings built between 1925 and 2022.

- 40 years, i.e. 2.5% per year for buildings built in 1924 or earlier.

This is laid down in § 7 (4) Nr. 2 EStG:

https://www.gesetze-im-internet.de/estg/__7.html

Re: UK property income in German tax return

Posted: Tue Jan 21, 2025 10:16 am

by cj1

Sorry to hijack this thread a bit...

And what if I have an investment property in Spain and I have already paid tax there at 19%

Do I still declare this on my DE tax return? Thanks

Re: UK property income in German tax return

Posted: Tue Jan 21, 2025 10:59 pm

by PandaMunich

cj1 wrote: ↑Tue Jan 21, 2025 10:16 am

And what if I have an investment property in Spain and I have already paid tax there at 19%

Do I still declare this on my DE tax return?

Yes, since the double taxation agreement (DTA) that Germany has with Spain

is the exception in that it has a

tax credit clause for rental profit in article 22 (2) b) vii):

https://www.bundesfinanzministerium.de/ ... onFile&v=1

- b) Spanish tax paid under the laws of the Kingdom of Spain and in accordance with this Agreement shall be credited against the German tax on the following income or assets located in the Kingdom of Spain, subject to the provisions of German tax law on the crediting of foreign taxes:

(vii) income from immovable property (including income from the disposal of such property) or the assets to the extent that such property does not effectively belong to a permanent establishment in the Kingdom of Spain.

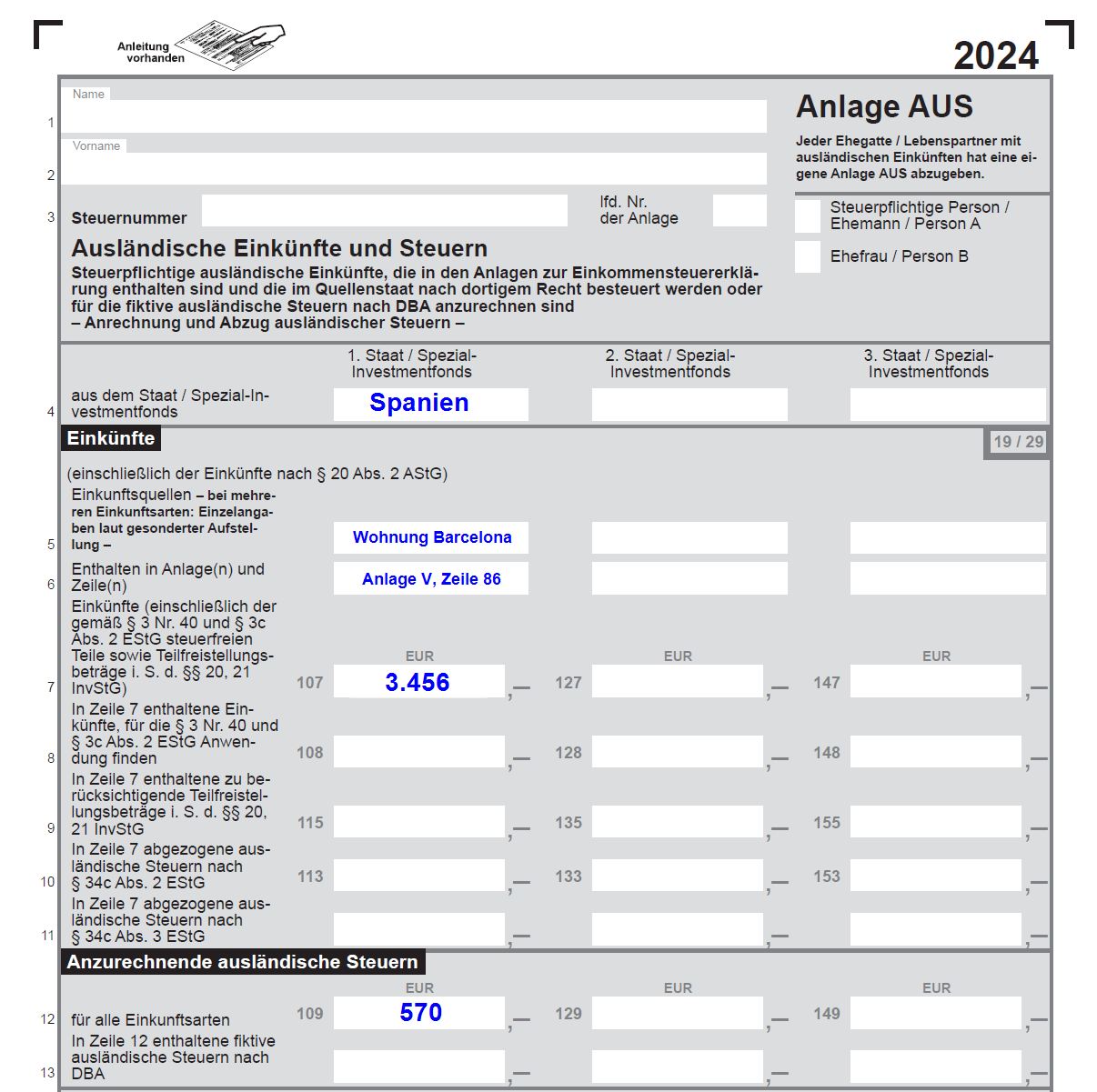

This means that yes, you also have to calculate your Spanish rental profit in your German tax return, in

Anlage V, where it gets

calculated according to German rules.

You also declare the resulting Spanish rental profit in

Anlage AUS, e.g. if the result of this Anlage V was

3,456€ for your

let flat in Barcelona and you had paid

570€ Spanish income tax (because calculated according to Spanish rules, your Spanish rental profit was only 3,000€ and you had paid 19% Spanish income tax on it), you fill in:

- 2025-01-21 22_49_44-aav_anlage_aus_2024.pdf - Adobe Acrobat Pro.jpg (193.57 KiB) Viewed 7387 times

*******************************************************************************************************************************

All other DTA that Germany has with other EU countries have a

progression clause which because of

§ 32b (1) Satz 2 Nr. 3 EStG means that that the rental profit from those EU countries does

not appear at all in the German tax return.

Re: UK property income in German tax return

Posted: Wed Jan 22, 2025 4:43 pm

by cj1

Thank you Panda, very nice of you

Re: UK property income in German tax return

Posted: Sun Jan 26, 2025 11:55 am

by Sam-I-Am

So now I'm completely confused!

Similar to OP: Employed, DE tax resident. Filling in declaration for 2024 and including rent from UK.

Without UK rental income my return projection (using SteuerGo) is a tax refund of €600. When I add rental income of £9000 I am supposed to pay an additional €800 additional German tax payment due to this UK rental income.

Similar to OP the rental income is below UK tax threshold (also declared in UK). Due to DTA etc why do I also have to pay so much added tax in Germany?

1. Is this because my global income is now higher so Germany tax me more on my German income

2. Did I miss something and am declaring too much UK rental income?

If 1. then this is a nasty surprise but I'll just have to swallow it

If 2. is this because I'm not taking account of building 'depreciation? That is the part that confuses me.

Edited: Does 'depreciation' start from when I bought the flat in which case I include paid price, lawyer fees etc or does it start from when the building was built in which case I can't use depreciated to help reduce income number)

Background. 1 bed flat was bought in 2013 for £220,000, it's a really old flat, built very early 1900's and I have no idea what it's worth now. I already deducted yearly Ground Rent and Building Maintenance costs from the rental income amount leaving approx. £9,000 as pure income.

Do I really have to figure out what the exchange rate was in 2013 and figure out depreciation and that stuff?

Re: UK property income in German tax return

Posted: Sun Jan 26, 2025 5:32 pm

by PandaMunich

Sam-I-Am wrote: ↑Sun Jan 26, 2025 11:55 am

Similar to OP: Employed, DE tax resident. Filling in declaration for 2024 and including rent from UK.

Without UK rental income my return projection (using SteuerGo) is a tax refund of €600. When I add rental income of £9000 I am supposed to pay an additional €800 additional German tax payment due to this UK rental income.

Similar to OP the rental income is below UK tax threshold (also declared in UK). Due to DTA etc why do I also have to pay so much added tax in Germany?

1. Is this because my global income is now higher so Germany tax me more on my German income

2. Did I miss something and am declaring too much UK rental income?

Mainly the former.

But you do also need to subtract the 2.5% depreciation (since the building was built before 1925) from your UK rental profit, which will bring the extra German income tax that will be due down by a bit, but not by much.

Sam-I-Am wrote: ↑Sun Jan 26, 2025 11:55 am

Edited: Does 'depreciation' start from when I bought the flat in which case I include paid price, lawyer fees etc or does it start from when the building was built in which case I can't use depreciated to help reduce income number)

From the date you bought it.

Sam-I-Am wrote: ↑Sun Jan 26, 2025 11:55 am

Background. 1 bed flat was bought in 2013 for £220,000, it's a really old flat, built very early 1900's and I have no idea what it's worth now. I already deducted yearly Ground Rent and Building Maintenance costs from the rental income amount leaving approx. £9,000 as pure income.

If you are paying "ground rent" then it is leasehold (Erbpacht) which means that what you paid in 2013 was

just for the building (you did not get to buy any land, you are paying rent on the land every year), which in turn means that you get to claim as a rental expense 2.5% per year of

100% of the:

- loaded purchase price = 220,000 GBP + solicitor fee + stamp duty + land register fee + any other fees associated with the purchase

Sam-I-Am wrote: ↑Sun Jan 26, 2025 11:55 am

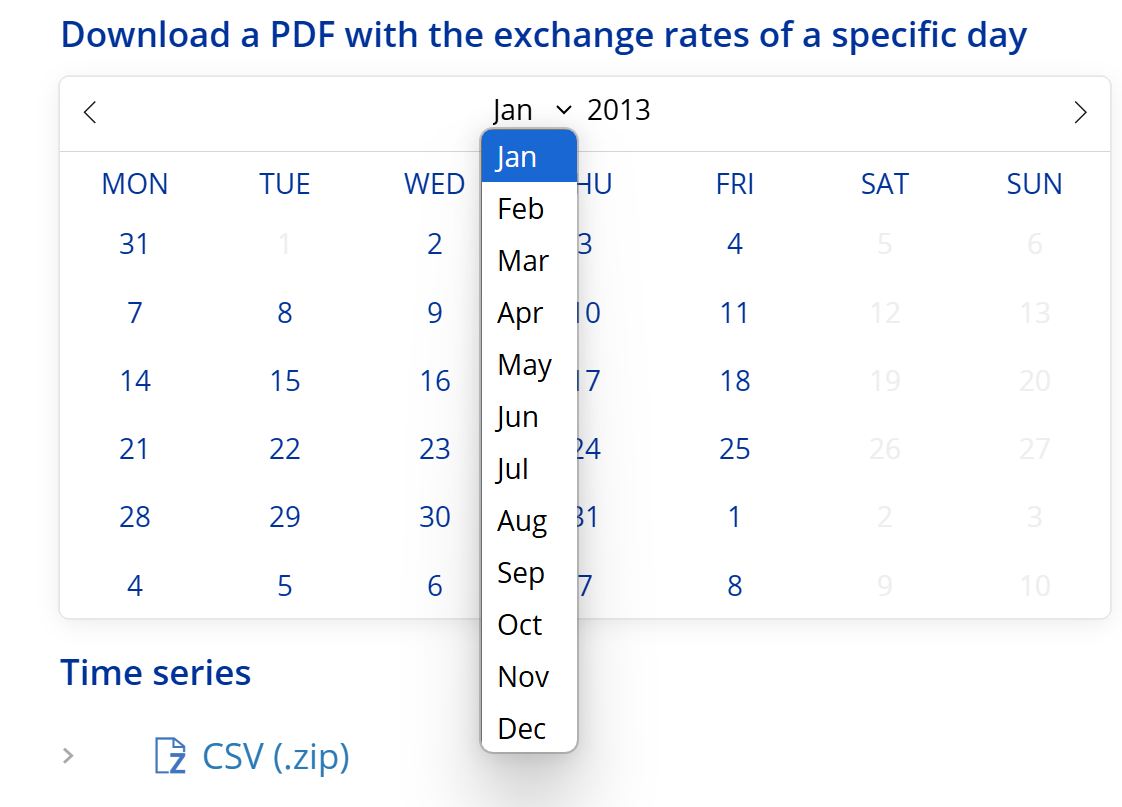

Do I really have to figure out what the exchange rate was in 2013 and figure out depreciation and that stuff?

Yes.

The ECB website has the historical GBP/€ exchange fee for the date of your purchase in 2013:

https://www.ecb.europa.eu/stats/policy_ ... ex.en.html

- 2025-01-26 17_29_53-Euro foreign exchange reference rates.jpg (66.72 KiB) Viewed 7129 times

Re: UK property income in German tax return

Posted: Sun Jan 26, 2025 5:56 pm

by Sam-I-Am

Thanks Panda... I don't know what we'd do without you

Re: UK property income in German tax return

Posted: Thu Jul 03, 2025 9:09 am

by CharlesB

I also have a couple of questions about this and I am very grateful to anyone who can advise, I am currently doing my German tax return with UK rental income for the first time, having had a Steuerberater do it for the years 2021,22, 23...

I have been through each month in 2025 and converted my UK rental income to Euro using the Bundesbank monthly averages, and for bills, repairs etc I have taken the daily rate of GBP to Euro on the date of the invoice. Would that be correct? For the 2% depreciation I have used the daily rate of GBP to Euro on the purchase date of the property.

One slight issue, one house I have was purchased in 1999 and I couldn't open any of the links given in previous threads ( also the link on the old site ) to convert GBP to DM and then convert to Euro. The Bundesbank website, as far as I can see, says " Ab Januar 1999 Euro Referenzkurse der Europäischen Zentralbank, siehe BBEX3:D:GBP:EUR:BB:AC:000.; " and for the purchase date of 11/6/99 gives a value of 0,65060, which pushes up the amount I could claim for depreciation a little...

Looking through the previous 3 tax returns prepared by my Steuerberater, they have simply taken the Jahresdurchschnittskurs for 2021, 22 etc and worked out all of the rental income / depreciation / Werbungskosten etc figures using that. Each time the tax return has been accepted by the FA. My German partner tells me that the FA doesn't have the time / resources to sift through each return and check monthly averages etc. Might there be any truth in that, given that for the first German tax submission in 2021 they asked to see my UK tax returns and have therefore been able to get a general idea of the rental income I have?

I would add that this is a Steuerberater who advertised / was very reputable on the old site.

Thank you again in advance for any advice!

Re: UK property income in German tax return

Posted: Thu Jul 03, 2025 9:10 am

by CharlesB

I should add "been through each month in 2024"....

Re: UK property income in German tax return

Posted: Fri Jul 04, 2025 1:27 am

by PandaMunich

The only reference to exchange rates that we have in income tax law is in the section about how to convert foreign tax amounts.

It says in there that we are supposed to use

daily exchange rates, but that

monthly exchange rates are also accepted, see R 34 (1) EStR:

https://esth.bundesfinanzministerium.de ... c-1-2.html

- Conversion of foreign taxes

11Foreign taxes to be credited against German income tax pursuant to Section 34c (1) and (6) of the German Income Tax Act (EStG) or to be deducted when determining income pursuant to Section 34c (2), (3) and (6) EStG shall be converted on the basis of the euro reference rates published daily by the European Central Bank. 2For the sake of simplicity, these currencies may also be converted using the VAT conversion rates published monthly in Part I of the Federal Tax Gazette.

--> this is why I use monthly exchange rates.

Re: UK property income in German tax return

Posted: Thu Jul 10, 2025 11:11 pm

by CharlesB

That's great! Thank you.