Page 1 of 1

Correction in the Steuerbecheinigung from 2018

Posted: Wed Oct 23, 2024 10:00 am

by alvesjr

Hi All,

I just received from Commerzbank a correction of my Steuerbescheinigung from the year 2018. What should I do? My tax declaration for 2018 was done by a company because it was the year I move from Belgium to Germany. This company does not provide any support anymore. Which form should be filled out for correction?

Really appreciate any help.

Best regards, Leonardo

Re: Correction in the Steuerbecheinigung from 2018

Posted: Wed Oct 23, 2024 1:54 pm

by PandaMunich

alvesjr wrote: ↑Wed Oct 23, 2024 10:00 am

I just received from Commerzbank a correction of my Steuerbescheinigung from the year 2018. What should I do? My tax declaration for 2018 was done by a company because it was the year I move from Belgium to Germany. This company does not provide any support anymore. Which form should be filled out for correction?

If including this corrected amount, your total worldwide capital income (interest, dividends, profit from selling stocks/funds/bonds and so on) in 2018 was up to 801€ (1,602€ for both of you, if you're married, you get to use your spouse's "unused" tax-free allowance for capital income), then you don't need to do anything.

If it exceeded that amount, make a copy of it, write your Steuernummer on it and send it to your local Finanzamt.

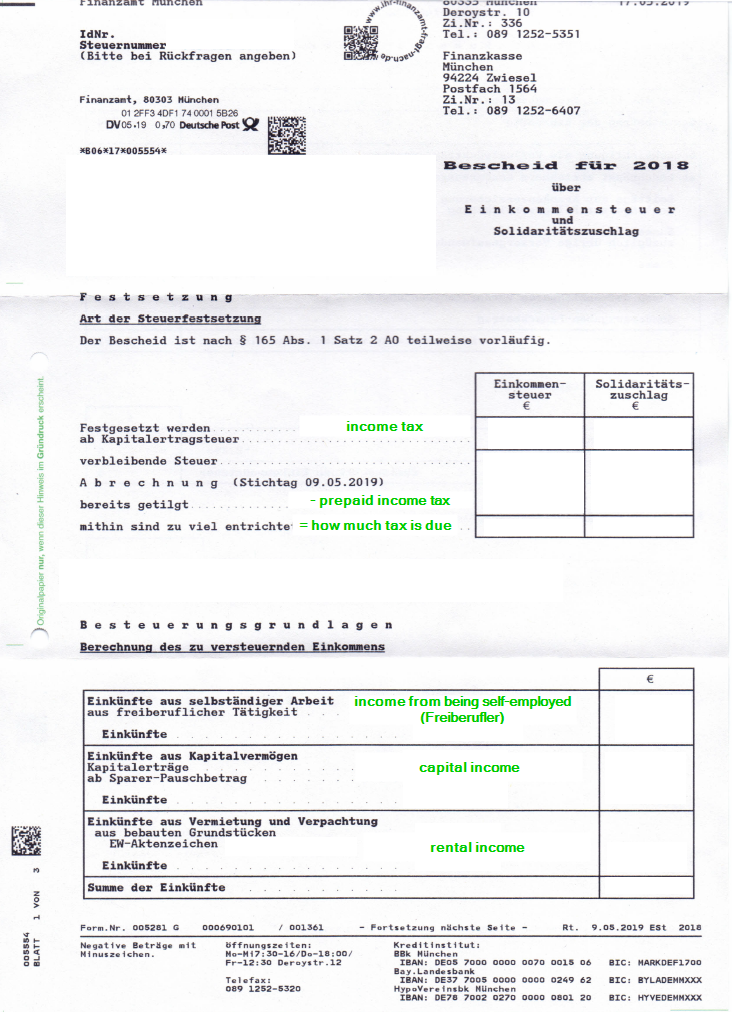

You can find your Steuernummer and your Finanzamt's name and address on your income tax Bescheid, which was the result of your tax declaration 2018, it looks like this:

- example-Bescheid-1st-page.png (717.81 KiB) Viewed 1660 times

Re: Correction in the Steuerbecheinigung from 2018

Posted: Mon Jun 09, 2025 4:56 pm

by kiplette

Slightly different Steuerbescheinigung question.

We've had ours from the Commerzbank. It has 0 entered all over it. Looks as though we don't enter anything in to Elster.

Last year we had a Festgeld Anlage which paid out 1,350 in June (2024).

I also had a blob of money from Premium Bonds. This takes us over the Sparerpauschbetrag.

We have entered the Premium Bonds into Elster. Then Elster is taking the whole 2K Sparerpauschbetrag off the Premium Bonds. This makes us tax dodgers, I think.

Can we each (joint tax return) simply enter the 675€ into Elster - line 17? and the Finanzamt will know what the total Kapitalerträge is and charge us the correct tax? (When we do this, the Prüfer button looks as though this works - we get taxed on total Premium Bond income - 650€ not yet used allowance)

Does it then matter that the Steuerbescheinigung doesn't match? Do we need to go down to Commerzbank and explain the problem? I did email bank dude about this, and he essentially said don't worry, there can be various reasons for the 0-s on the Bescheinigung and just go with it. We don't really trust him because he recently told us a lot of rubbish about paying off our mortgage (we will be leaving the Commerzbank when our mortgage paperwork comes back).

It's possible they think we are not Steuerpflicht in Germany because we weren't at the start of our relationship with them. Maybe that is the root of the problem.

Re: Correction in the Steuerbecheinigung from 2018

Posted: Mon Jun 09, 2025 10:52 pm

by PandaMunich

kiplette wrote: ↑Mon Jun 09, 2025 4:56 pm

Can we each (joint tax return) simply enter the 675€ into Elster - line 17? and the Finanzamt will know what the total Kapitalerträge is and charge us the correct tax? (When we do this, the Prüfer button looks as though this works - we get taxed on total Premium Bond income - 650€ not yet used allowance)

Does it then matter that the Steuerbescheinigung doesn't match? Do we need to go down to Commerzbank and explain the problem? I did email bank dude about this, and he essentially said don't worry, there can be various reasons for the 0-s on the Bescheinigung and just go with it. We don't really trust him because he recently told us a lot of rubbish about paying off our mortgage (we will be leaving the Commerzbank when our mortgage paperwork comes back).

It's possible they think we are not Steuerpflicht in Germany because we weren't at the start of our relationship with them. Maybe that is the root of the problem.

No, fill them into line 18 "Inländische Kapitalerträge (ohne Beträge laut den Zeilen 24 bis 26a)" in the section "Kapitalerträge, die nicht dem inländischen Steuerabzug unterlegen haben" of each of your Anlagen KAP.

It will have the same effect as putting them into line 17, but that is the correct way.

kiplette wrote: ↑Mon Jun 09, 2025 4:56 pm

It's possible they think we are not Steuerpflicht in Germany because we weren't at the start of our relationship with them. Maybe that is the root of the problem.

You need to get this fixed asap, since you are now regular residents.